How Can I Make Money With Bitcoins

If y'all don't know much nigh Bitcoin, then this guide is for you. This digital currency was relatively obscure until 2017.

Later the popping of the Nifty Bitcoin Bubble of 2017, almost everyone in the developed and emerging markets knew nigh Bitcoin, regardless if they bought any or non. Bitcoins' recent resurgence upward toward the $ten,000-marking seems to be setting a new price floor for the cryptocurrency.

Bitcoin fever is starting to gain momentum once more, with some analysts predicting a movement up towards $50,000. If you desire to position yourself for the adjacent Bitcoin bull-run, so you demand to understand the opportunities that be in this market.

By positioning yourself before the growth of the adjacent Bitcoin bubble, you stand to make a speculative proceeds in dollar value that could prepare you upwardly financially for life. This guide will give yous a few strategies you can implement to earn Bitcoin and create a future for yourself in the economy of digital currencies.

A Cursory History of Bitcoin

Contents

- 1 A Cursory History of Bitcoin

- ii A Brief History of Bitcoin Bubbles

- 3 Millennials and Bitcoin

- 4 Is Bitcoin Money?

- v How to Earn Money with Bitcoin

- 5.1 Buy and "HODL"

- 5.ii Trading the Bitcoin Markets

- 5.three Cryptocurrency Mining

- 5.4 Become a Bitcoin Consultant

- 5.5 Network Marketing Opportunities

- 5.half dozen Lending Bitcoin

- 6 Threats to the Future of Bitcoin

- vii In Closing – Is Bitcoin the Future of Money?

The world'due south concept of money changed when, on Oct 31st, 2008, "Satoshi Nakamoto" published a whitepaper on a peer-to-peer digital greenbacks system. Bitcoin was zippo more than than an thought for years until it caught the attention of traders.

In the early on stages of Bitcoin'south development until 2010, the world had no idea of bitcoin's coming value. The only people that knew nigh the cryptocurrency were tech-heads and gamers. It was in this initial phase of the cryptocurrencies determinative years, where 1 of the biggest fiscal blunders of all time occurred.

On May 22nd, 2010, Laszlo Hanyecz – a Bitcoin enthusiast, made the world's first Bitcoin transaction. Laszlo ordered two Papa John's pizza's and paid for the delivery with ten,000 Bitcoins. At Bitcoin's current toll average sitting around the $10,000, that would get in $fifty-million for each pizza – and that'southward before we include the tip.

This event ranks right up there with the Microsoft founder, Ronald Wayne, who sold his 10-per centum stake in Microsoft for $800, which would now be worth around $90-billion. Bitcoin got some notoriety in the gaming community over the coming years, but information technology wasn't until Mt. Gox came onto the scene in 2011 that Bitcoin exploded into the mainstream.

Some 7-years afterward, and we are sitting at the threshold of Bitcoins 11th altogether. Think well-nigh that for a infinitesimal. Bitcoin is but 11-years old as a technology. The amount of disruption this currency caused over the last 7-years is incredible to witness.

Nihon recognized Bitcoin every bit a legitimate currency back in 2014, and many other nations followed suit. Bitcoins ATMs are no readily bachelor in many countries throughout the developed and emerging markets. Today retailers have Bitcoin as a means of payment, and the cryptocurrency even appears in popular civilization in serial like "Mr. Robot."

Bitcoin is nevertheless in its infancy, and information technology has a long mode to become in the future. Who knows where it volition finish up. There are some analysts that suggest Bitcoin is the future of the financial organisation. Others state that there are existential threats to the survival of the cryptocurrency sector.

No 1 knows what the time to come holds for digital currencies. However, one thing is certain; they represent a new offset in finance. While governments shift to accommodate crypto into their view of world economics, many leaders in the industry are jumping on the bandwagon.

Facebook recently announced its plans to launch "Libra," a cryptocurrency exclusively controlled past Facebook. However, governments didn't like the thought of coin launderers and drug dealers being able to motility coin across borders to evade capital controls. Thus, Libra recently got dropped by most of the big tech companies supporting the new crypto.

All the same, Bitcoin remains the nearly pop digital currency. Looking at the daily trading volumes of the crypto sector, and the market caps of all of the coins, it's clear that Bitcoin is the simply real game in town.

Read: Should You lot Invest in Bitcoin? Complete Beginner's Guide

A Cursory History of Bitcoin Bubbles

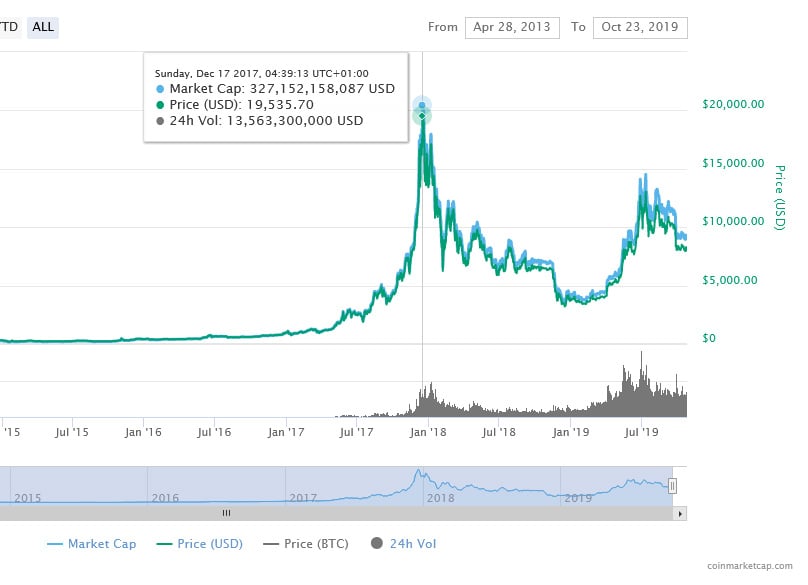

The Great Bitcoin Bubble of 2017 made every other fiscal bubble before it, seem like a regular mean solar day on the NYSE. Subsequently reaching heights of nearly $xx,000 a coin, the Bitcoin cost slipped down to the $3,300-marking.

However, the cryptocurrency steadily recovered toward the $11,000—handle over the coming year, and as of the start of Q4, 2019, the Bitcoin price is $8,300, later on a selloff from the $10,000-mark.

The Bitcoin Chimera of 2017 caught anybody off-baby-sit, even seasoned Bitcoin believers. The growth in the currency's value from the $iv,000-handle to $20,000, took less than 9-months, and nigh economists have never witnessed anything like it in their lifetimes.

As the toll crossed the $x,000-handle for the outset time, the world started to go Bitcoin fever. The growth to the $twenty,000-handle barely took two-months, and people thought that Bitcoin could reach $i-meg a coin.

Yet, this mania was short-lived. The cryptocurrency crashed over the get-go three months of 2018, giving many investors a hard landing in the process. During the height of the mania, in that location were reports of people doing stupid things to acquire Bitcoin.

Stories of people putting mortgages on their homes to purchase Bitcoin were common, and the stories of scams involving mining companies and ICOs connected to abound. The ICO mania sparked by the rise in the Alt-coin sector also price many investors their shirts.

As the FOMO (fear of missing out) grew effectually Bitcoin and ICOs, people piled into information technology with everything they had and ended upwardly losing everything they had.

Millennials and Bitcoin

While it may take endured the biggest financial bubble in history, Bitcoin still has a loyal fan-base that believes in the cryptocurrency. Millennials are the biggest generation of users, miners, and holders (HODLer's) of Bitcoin. Millennials grew up at the get-go of the information age. As a effect, they are the first tech-savvy generation.

Most millennials grew up with cellphones, and they know how to utilise devices and the internet to make money. Millennials now account for more than than 60-percent of the workforce, and they are starting to move into the phase of life where they purchase homes and commencement families.

As a result, Bitcoin will continue to play a role in millennials' lives in the hereafter. Every bit more retailers come up online and take Bitcoin payments, the network grows. The simply thing stopping Bitcoin from becoming the world's adjacent reserve currency is the government and general credence.

Governments won't allow Bitcoin to go a reserve condition currency. Reserve and national currencies are the means of collecting taxes from the public. Since Bitcoin is virtually bearding, in that location is no way governments tin can take it for payment of taxes. Therefore, they will choose to outlaw Bitcoin before they have information technology.

Notwithstanding, millennials are okay with working outside of systems of authority. If y'all're a tech-savvy millennial locked out of the fiscal system due to defaulting on pupil debt, Bitcoin offers a new lease on life. If you know what you are doing, you can pay for anything you demand using Bitcoin, and you can accept it for payments besides.

Read: Best Investment Ideas for Millennials: Complete Guide

Is Bitcoin Money?

If people are willing to use Bitcoin as a means to settle debts, other than taxes, this begs the question; Is Bitcoin money? Sound coin has a few characteristics worth noting. First, you can utilise it for the settlement of debts. Second, information technology has a fungible value, meaning each unit is equal or divisible by another. Coin is also portable, durable, and a store of value over time.

If we look at the oldest form of money, gold, then it fits this clarification perfectly. However, the dumbo mass of gold bullion may brand it challenging to transport large quantities. Nonetheless, gold is a good store of value over the centuries, and information technology is also divisible, fungible, and durable.

If we compare the US Dollar to these same criteria, we come up up short. Since the advent of the Federal Reserve in 1913, the Greenback lost more than 96-pct of its purchasing power. That's doesn't make fiat dollars a very good store of value for investors.

However, the dollar reigns because it controls the globe's credit system as the leading reserve currency. If countries want to settle international debts, they need to do information technology in dollars. Therefore, the Greenback gets its acceptance as money through the fact that the world uses information technology to settle debts and pay taxes.

Bitcoin meets the criteria of Fungibility, divisibility, and it'southward an accepted medium of substitution. Even so, it's easy to lose your Bitcoin wallet keys, along with your Bitcoins. Bitcoins are like shooting fish in a barrel to hack in hot wallets, and the price is too volatile to human action as a shop of value.

Therefore, we tin say that Bitcoin does not however fit all the criteria to qualify as sound coin. However, in today'south fiat Dollar historic period, information technology'south clear that money has evolved into a different animal.

Read: Is Cryptocurrency the Future of Money? Allow's Take a Look

How to Earn Money with Bitcoin

Now that you have a clear concept of Bitcoin, let's expect at how you can make some money with this digital asset. We outlined the post-obit strategies to aid y'all go started on learning more about how Bitcoin can supplement your income.

Selection a strategy that makes sense to y'all and execute information technology today. There is plenty of information online to expand on the strategy mentioned beneath. Nonetheless, the most of import thing is that you lot take activeness. By taking activity, you lot'll get ahead of the masses, and book yourself a spot in the digital economy of the future.

Purchase and "HODL"

When people remember of buying into Bitcoin, they imagine the huge windfall they make when selling their coins for dollars as the price peaks. This strategy is known as ownership and holding. It's a popular method used past gilded investors, and information technology operates within an investment portfolio as a hedge against market volatility.

Typically, investors will classify the king of beasts'south share of their portfolio to stocks and bonds, and so effectually 5 to 10-per centum to physical gold bullion in the form of coins or bars. For some reason, Bitcoin believers remember that ownership and holding also apply to Bitcoin as well. True believers in the cryptocurrency will tout their buy and agree strategy as the reason why the Bitcoin price remains stable.

In a way, that's a truthful statement. As we discussed in the section about the dollar as money, information technology takes participation and belief from the public to give money whatsoever value. Yet, that does not mean that you have to follow a buy and hold strategy to provide any validity to the Bitcoin market.

Bitcoiners that hold for the long term telephone call themselves "HODL'ers," a misspelling of "Agree".

However, the mistake many of these people brand is that Bitcoin is not yet what we would consider a store of value, whereas golden has a 2,500-year history every bit sound coin.

Therefore, people seem surprised when the toll reaches $twenty,000, and and then plummets to $three,300. Holding over that period would be fine if you bought in at less than $2,500, only what if you entered at $ten,000? You would be looking at a serious financial loss.

Still, If you exercise stick to the strategy and HODL for the long-term, and then you lot should yet see a return. Those Bitcoiners notwithstanding hodling their coins from 2009 are smile all the way to the banking company. However, the point is that they wouldn't exist cashing the coins in at whatsoever stage, but rather using Bitcoin as a store of wealth over the long-term.

Coinbase is the easiest exchange to purchase Bitcoin using bank account, debit or credit card. Read our full review to find out more.

Trading the Bitcoin Markets

If you want to brand serious coin with Bitcoin, then Day-trading the cryptocurrency markets are bar far the superior option. The cryptocurrency market place operates almost in the same manner equally the forex and stock markets.

Buyers and sellers run across on a platform, as well known every bit an exchange, and trade cryptocurrency with each other in the promise of making a profit from the arbitrage. Cryptocurrency exchanges like Binance, Bittrex, and Bitfinex, offer the same services the crypto traders, as NASDAQ, NYSE, and FTSE to day traders of equities and currencies.

The divergence between the crypto and forex is that forex is a regulated market. Government entities, such as the SEC, regulate traders and companies for operational compliance within the law. In the crypto market, it's the wild west.

Binance is the all-time exchange for trading Bitcoin and other cryptocurrencies, read our total review.

As a result, there are stories of exchanges violating withdrawal policies, and stories about mass-manipulation of the markets past some corrupt exchanges. The reality is that some of this is true, and some exchanges are frown to take all of your coin.

Crypto exchanges operating outside of the Usa don't take to follow international KYC policies for acquiring new clients, as long as those clients don't withdraw in USD. Every bit a outcome, you tin can only withdraw from offshore exchanges in cryptocurrency. Yous'll then have to send that crypto to a wallet at an substitution like Coinbase to redeem it into USD.

If you annals with an exchange similar Coinbase, they have offices in the Us. Therefore, yous'll need to provide all your KYC documentation when making a withdrawal. Yet, you can turn your BTC into USD, and accept Coinbase deposit it directly into your bank account.

If yous practise utilize Coinbase, you'll accept to call back to keep some of your crypto profits to pay taxes. Coinbase reports user information to the IRS, and the IRS demands that you pay tax on your profits. Avoid an audit, and brand certain you lot file for revenue enhancement, speak to your accountant for communication.

Otherwise, trading the crypto markets is very profitable if you know what you are doing.

The issue with trading crypto is the volatility in the price action. It's possible to see the cost of cryptos swing x to xx-percent in a single trading session. This kind of price swing doesn't happen in stable, regulated financial markets.

Still, if you find a mentor with a good trading strategy, it's the most profitable means of making coin with Bitcoin.

If yous are trading crypto, you lot can make use of trading bots like 3Commas and Cryptohopper which will automatically merchandise for you – you just need to signup and connect them to your exchange business relationship and pick a certain set up of parameters to execute your trades.

We take reviewed both trading platforms:

- Cryptohopper Review

- 3Commas Review

Cryptocurrency Mining

When Bitcoin kickoff started, information technology was possible to mine the blockchain for Bitcoins using your desktop computer. However, every bit people got air current of the toll increases with the cryptocurrency, more people started buying meliorate computers for mining. Somewhen, it wasn't long before tech companies began designing and building "mining rigs."

With a mining rig, y'all could mine different coins faster, producing better returns. Yet, technology kept improving, and miners kept getting smarter. Miners started connecting multiple platforms to increase hash power, creating "mining farms."

Presently, mining companies started forming in Asia, backing by subsidized energy costs, enhancing mining profitability. Equally the Bitcoin Mania crept toward the all-time high of $20,000, more than miners started coming online, improving the hash rates.

However, it made it near impossible for anyone to mine Bitcoin using regular computers and specialist rigs called "ASICs" were produced which costs thousands of dollars.

However, there is a mode to brand money mining Bitcoin without moving to Cathay to ready a mining farm. With the recent drib in Bitcoin price from the $eleven,000-handlle to the lower $ 8,000'due south, many mining companies are going broke that bought equipment at prices above the $x,000-handle.

As a upshot, you can find second-paw mining rigs, with plenty of service life, for sale prices on sites like eBay. Purchasing 1 or two of these professional rigs and set them upwardly in your garage and you can mine some less-popular coins and then trade these for BTC on an exchange.

The returns won't be great but they are a fashion to get your foot in the door and if you lot pick a good money and hold it, it may increase in value later on on.

Become a Bitcoin Consultant

People that get involved with Bitcoin find themselves learning a lot about cryptocurrency in a short catamenia. For some people, the data overload is besides much to handle, and they can't grasp the topic. Others find the blockchain and hot and cold wallets fascinating, soaking up all the technicalities around the industry.

If you lot start learning about Bitcoin, 6-months afterward, y'all'll find yourself an expert near everything to exercise with the topic of cryptocurrency. If you put in the time to study how the markets work, and how to trade, sell, and buy cryptocurrency, that's valuable cognition.

Some people volition pay you to learn what you know. You lot could put together information courses on how to trade, purchase, and sell, crypto, and and then promote information technology through social media. Selling a virtual production means yous keep no physical inventory, reducing your overhead costs of doing business.

Bitcoin consultants are in loftier demand, fifty-fifty in a falling market. If you build your reputation as an expert in crypto, eventually, you lot'll start to obtain a customer base. When the next Bitcoin bull-run comes around, yous'll notice yourself in the perfect position to benefit from the adjacent bubble.

Network Marketing Opportunities

When you put the words "networking" and "Bitcoin" in the same sentence, nearly people beginning to hear alarm bells going off in their heads. At the elevation of the Bitcoin bubble, there were plenty of network marketing schemes promising bitcoin for noting.

These network marketing scams typically offered people an investment shareholding in a bitcoin mining farm. Every bit more investors came into the system, the farm buys more than equipment, and the hash rate of the subcontract improves.

All the same, many of these farms were a scam. They would operate for four to half dozen-months, bring in thousands of suckers through network marketing schemes, and then disappear with everyone's money. Since most of the farms registered as businesses in China, the investors lose everything overnight.

Even so, in the wake of the bubble and the economic destruction of network marketing scams, new businesses developed to fill in the gaps. Now at that place are legitimate network marketing opportunities in cloud mining.

If yous do your research and observe a reputable Bitcoin network marketing visitor, it offers you a foothold into the industry. Information technology typically doesn't price much to enter into network marketing organizations, and the returns are fantastic if you work hard to build your downline.

Lending Bitcoin

Ane of the biggest benefits of Bitcoin and a feature that makes it valuable to people using it online is its decentralized nature. Bitcoin is non under the control of any government or central banking company. Essentially, information technology's a lawless currency. However, Bitcoin gets its integrity from the blockchain technology, supporting every transaction that goes through the network.

People manage blockchain, not banks or governments. Equally a result, you don't have to adhere to financial laws surrounding lending. Lenders in the fiat currency market place of The states Dollars need to adhere to financial legislation and register as a financial services provider to engage in transactions with investors and the public.

All the same, you don't need whatsoever of this compliance to exercise this in the cryptocurrency world. As a result, null is stopping you from setting up an commutation if you wish. There's no-one that will prevent you from setting up a lending agency wither. Both of these markets offer unique opportunities for people to make money in the next evolution of Bitcoin.

At that place are already lending platforms bachelor at offshore exchanges. Unchained Capital, BTCpop, and Bitbond infringe your bitcoin for an APR involvement rate of up to fifteen-percentage. Yous tin use these lenders to grow your Bitcoin profits. All yous do is send them your Bitcoins, and they ship yous a monthly income or an increase in the equity of your cryptocurrency account with the exchange.

These lenders then use your crypto to trade the markets, banking the profits they make with your capital after paying you your interest.

Threats to the Future of Bitcoin

Investing in Bitcoin is not without chance. As with any nugget grade, you demand to understand the risks involved with the digital currency before you hand over your dollars for digital tokens. At that place are numerous risks to the Bitcoin economy. However, in this article, we'll await at 3 that nosotros believe could damage the future of the cryptocurrency and your profits.

The beginning effect nosotros have with Bitcoin comes with the technology used to run the blockchain. Final month, Google announced information technology successfully manufactured the world's offset quantum calculator. The 53-qubit car is said to exist the first in an evolution that volition run into processing power double with each new generation.

If that's the case, then we but demand 3 or four evolutions of the technology before it can crack 256-flake encryption. If this were true, then quantum computers would allow hackers to infiltrate and accept downwards the blockchain.

With computing power exceeding the blockchain capabilities, it won't exist long before Bitcoin becomes obsolete. It'southward unclear at this phase if another cryptocurrency using quantum calculating would ascension to take its place.

The second risk to Bitcoin'southward future comes in the course of financial fraud. Twitter user @bitfinex'd did a marvelous task of roofing the 2017 Bitcoin chimera. @bitfinex'd believe the sole reason for the rise in Bitcoins toll during the bubble was due to tether.

Tether is a "Stablecoin" that traders utilize to escape the market during volatile periods. You sell your Bitcoin for tether at a 1:1 value and then wait for the cost action in the market place to settle. You so exchange tether for Bitcoin and keep trading.

Even so, @bitfinex'd show that tether pumped billions of dollars' worth of tethers into the market, with no proven reserves to back the tokens. As a issue, they "pumped" the market higher. When they somewhen stopped printing tethers, the market toll of Bitcoin collapsed.

There are various other institutions that dorsum @bitfinex'd claims, and think that the entire bull-run was one of the biggest fiscal frauds in history. The consequence is that Bitcoin is not a regulated market. Therefore, the SEC struggles to put together a case to take the owners of the tether company to task for their deportment.

The final threat to Bitcoin comes in the form of Bitcoin whales. According to inquiry, twenty-percent of Bitcoin addresses hold more than than 80-per centum of all of the Bitcoins. When these "whales" decide to sell or buy Bitcoin, they cause massive shifts in pricing. Take, for case, the Mt. Gox trustee.

This trustee managed the sale of thousands of Bitcoins in the first quarter of 2018. The trustee sold off $312-million worth of Bitcoin between January and June 2018. Some analysts believe that these sales were the catalyst for the sudden crash in Bitcoins price around the same time.

In Closing – Is Bitcoin the Time to come of Coin?

As you can see, there are plenty of strategies for making money with Bitcoin. Which methods yous decide to utilize is up to you, but you tin be sure that you lot'll start earning Bitcoin soon afterwards starting your journeying.

By positioning yourself earlier the adjacent large Bitcoin bull-run, you stand to make a killing when the adjacent toll run begins. However, there'southward no guarantee that the event volition ever take place. With then many existential threats to Bitcoin'south existence, at that place's a chance the unabridged crypto-ecosystem could implode.

However, regardless of whether Bitcoin survives the next decade or not, it'southward changed the financial organization forever. Governments are now talking about implementing state-sponsored cryptocurrencies for payments. Private institutions are working on improvements to the blockchain, and new ideas for digital currencies.

Bitcoin has already changed the future of money. Nonetheless, information technology remains unclear if it will be here in the future. Whether we see Bitcoin succeed in global adoption in the coming decade, or we see it slide abroad into obscurity, there is still value in it in today's market.

Apply these strategies to brand yourself a cryptocurrency portfolio and earn some money from Bitcoin.

six,807

Source: https://moneycheck.com/how-to-make-money-with-bitcoin/

Posted by: covarrubiaswheyed.blogspot.com

0 Response to "How Can I Make Money With Bitcoins"

Post a Comment